"All that glisters is not gold;

Often have you heard that told:

Many a man his life has sold

But my outside to behold:

Gilded tombs do worms enfold

Had you been as wise as bold,

Your in limbs, in judgment old,

Your answer had not been in'scroll'd

Fare you well: your suit is cold.'

Cold, indeed, and labour lost:

Then, farewell, heat and welcome, frost!"

-William Shakespeare

I had to do this.

A quote from William Shakespeare. About how all that glitters is not gold. Or what seems to be gold on the outside may not be gold on the inside and what seems to be gold on the inside may not be readily apparent to others on the outside. The depth of this man's wisdom is timeless and such is William Shakespeare, a man remembered for his profound literary works.

This idea that not all glitters is gold can also be applied to sensible investing. The glamour stocks of today will be the down trodden of tomorrow due to the reversion to mean, a mental model borrowed from statistics.

I would have to say that in a small subset of glamour stocks, the above may not hold true. Some glamour stocks continue to be glamour stocks because of the strong moat which they posess. And this is the realm of Warren Buffet and Charles Munger. From my experience, it is very difficult to spot such opportunities. And even when you find a company that is moat-worthy , how does one determine the price to pay for such a company? That is absolutely the reason why Warren Buffet mentioned that to be successful in investing, one need only find 20 such companies in a single lifetime and sit on it. Personally, i have not reached that utopian situation. I am still working on it. But I have developed my own mental models to deal with this issue but that is beyond the scope of this article for now.

(more…)

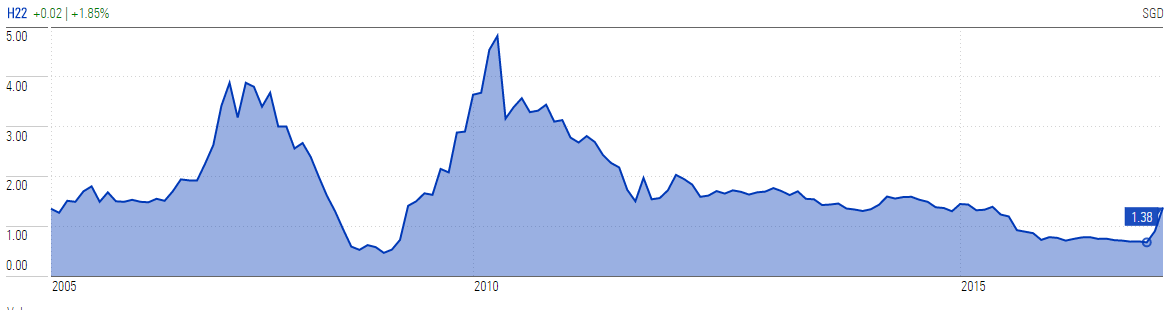

On the 27th of November 2016, I noted an entry into my investing journal. My modus operandi is to create a master folder of companies that I am interested in. And within these folders contain the information with which I do my research. The folder may also contains annual reports, links to news articles in the media and any filings related to the company. Within 1 of these master folders contained a company called Hong Leong Asia Ltd, a holding company of various subsidiaries operating in diverse industries. It has a total of 5 core business segments. They are: (more…)

On the 27th of November 2016, I noted an entry into my investing journal. My modus operandi is to create a master folder of companies that I am interested in. And within these folders contain the information with which I do my research. The folder may also contains annual reports, links to news articles in the media and any filings related to the company. Within 1 of these master folders contained a company called Hong Leong Asia Ltd, a holding company of various subsidiaries operating in diverse industries. It has a total of 5 core business segments. They are: (more…)