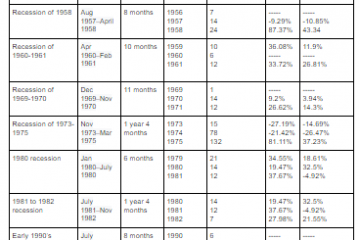

We all know the story that has been over sensationalised by the media. Buy a moated stock and leave it be. And watch your wealth grow. But as I said before. It is very hard to find a moated stock that will keep growing.

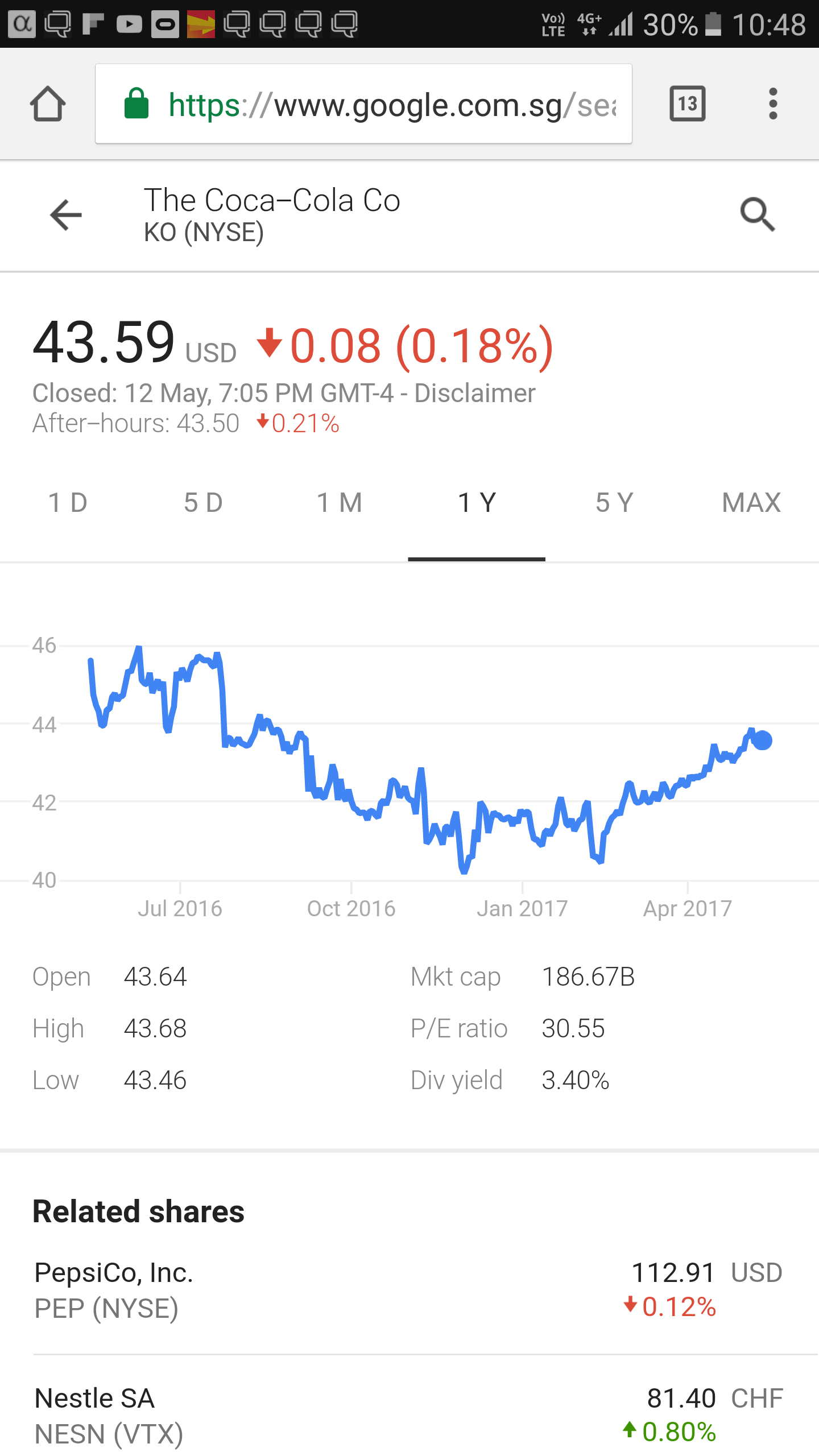

So the chart above shows a company whom many know. Coca Cola. At a price to earnings ratio of about 30 times. Its performance has not been great over the last 12 months.

Then let us look at a low price to book type company.

Hong Leong Asia. Its performance has been astounding compared to Coca Cola over a one year period. And these are the kinds of companies that I am looking at right now until I reach the utopian situation where my portfolio becomes too large to consider such companies as suitable candidates as reinvestment risk becomes larger.

For Hong Leong Asia, it’s PE cannot even be calculated for its trailing 12 month earnings is negative! Why buy then? Well this is a position I take for I am taking a contrarian view.

Once again, caveat emptor here. This is a cowboy’s comparison of value.