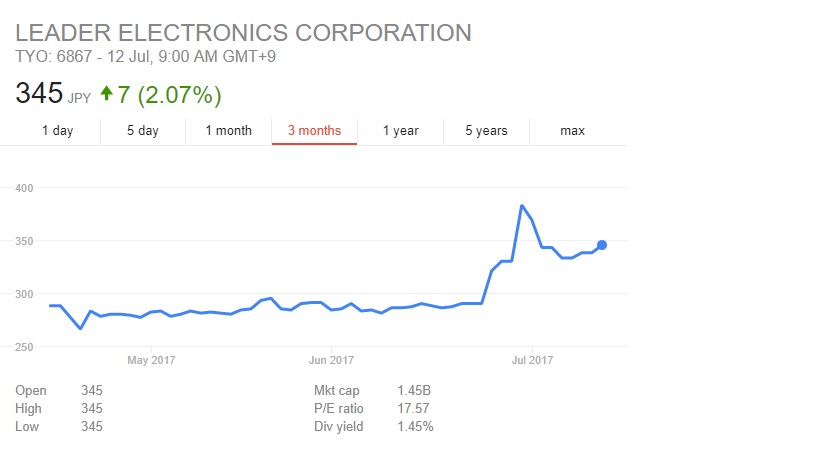

It has been a long time since I actually had the time to sit down and write. I would like to keep this article short and sweet. Perhaps, maybe this article will allow me to portray the “contrarian” in me. And by the way, I am invested in Leader Electronics Corporation. So first and foremost, a little profile of Leader Electronics Corporation.

About Leader Electronics Corporation

Leader Electronics Corporation is in the business of developing measuring instruments and it is a small company with only 79 employees. Its headquarters is in Japan. Some of the instruments which it develops are:

- level meters

- oscilloscopes

- video products

- audio products

I mean that being said, on the whole, its products are boring, generic and it is even a small company, which is in our opinion ignored.

Our opinion

I think many Warren Buffett enthusiasts will stay away from a company like Leader Electronics Corporation. It is old. It is boring. And perhaps, it does not offer much prospects of an exciting growth in operating income.

And because of that investors shy away, causing the stock to languish at levels of ridicule. The illogicality of these levels can be a good thing, especially for smart investors who play a mental game of “Tails I lose, Heads I win big.”

Companies like these are terribly boring. And not to mention, it is unsexy as unsexy can be.

But here at theholyfinancier.com, we love it.

I wish I had numbers to back this up but if I did a poll on whether investors loved this stock, I believe that many would think this to be one to stay away from. Take a look at this.

Falling revenues

Let us address the issue of falling revenues. It’s revenues have fallen over the last 3 years from 2.7 billion JPY to 2.33 billion JPY. So with regards to that, we would say that it does not seem very impressive on the revenues front.

Poor margins

It’s margins are poor and this resulted in a net income figure that was positive in only 2 out of 5 years. And in 1 year alone, in 2016, net income was slightly negative.

But by and large the last 3 years(2015,2016,2017), while they were suffering from falling revenues did prove to be fairly successful as compared to 2013 and 2014.

Then why invest anyway?

Herein lies the secret. Anyway, it is actually no secret. But in a market driven by earnings, in a market where valuation is always conducted with relation to the earnings of a corporation, few would want to invest in such companies. The way we look at it is this. We always look and study the assets of these companies. Which is what most investors don’t do anyway. And if we feel comfortable that it is trading at an acceptable price, we buy it.

However, most of us would never look at the assets in the way we should. Assets after all constitute the lifeblood of the company. Before a company earns profits, it has to have assets to generate that profit. Before a REIT becomes one with a good yield, it needs to lease out its valuable real estate(assets) to others.

Why then do many not look at the assets of the company? This is a puzzling question. In any case, this “mindset” presents opportunities to the astute investor, should one choose to sit up and take notice.

And if you find yourself reading this post right, squirming in your seat because you disagree with me, you may find that your views come from the other side of the fence.

Then of course, the next thing is to do an honest examination of your investment results.

To be a successful investor, one has to swallow the bitter pill, take some time to rewire themselves and view investing in a slightly different manner through the eyes of a contrarian. Should you choose to be one, your path would be a lonely one but you will make more money than most would in their lifetimes.