Deep Value Investing

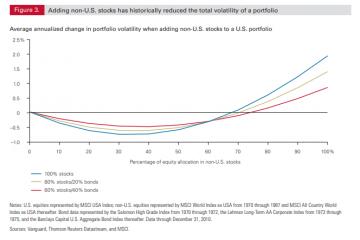

International Value Investing & Diversification

International Value Investing While the US stock market has been a relatively good performer as compared to other stock markets around the world, it would not be wise to expect that this will continue over Read more…