Herd Mentality

Paying Up For Growth: You’d Better Know What you Are Doing

Let us do a mathematical experiment here. A company earns $10 per share and out of that, pays a dividend of $8 per share. If one were to apply a 20 times multiple in the dividend stream going forward , the value of the dividends in perpetuity is $160. So we could make the argument here that the company is worth at least $160 if the dividend stream is fairly consistent. The $2 per share in retained earnings could lead to some real growth in the future. So if an investor decides to pay $100 per share for that company, that would be considered a good buy from an investor's stand point.

(more…)

Let us do a mathematical experiment here. A company earns $10 per share and out of that, pays a dividend of $8 per share. If one were to apply a 20 times multiple in the dividend stream going forward , the value of the dividends in perpetuity is $160. So we could make the argument here that the company is worth at least $160 if the dividend stream is fairly consistent. The $2 per share in retained earnings could lead to some real growth in the future. So if an investor decides to pay $100 per share for that company, that would be considered a good buy from an investor's stand point.

(more…)

Chart Of Thalassa Holdings

They say that time is the friend of a great business but the enemy of the mediocre. While that statement has a pervading ring of truth to it, the sagely quote excludes commodity businesses with a high probability of self sustenance and mean reversion into the future. Can I tweak that to say time is the friend of those companies that can survive an industry downturn?

Chart Of Thalassa Holdings

They say that time is the friend of a great business but the enemy of the mediocre. While that statement has a pervading ring of truth to it, the sagely quote excludes commodity businesses with a high probability of self sustenance and mean reversion into the future. Can I tweak that to say time is the friend of those companies that can survive an industry downturn?

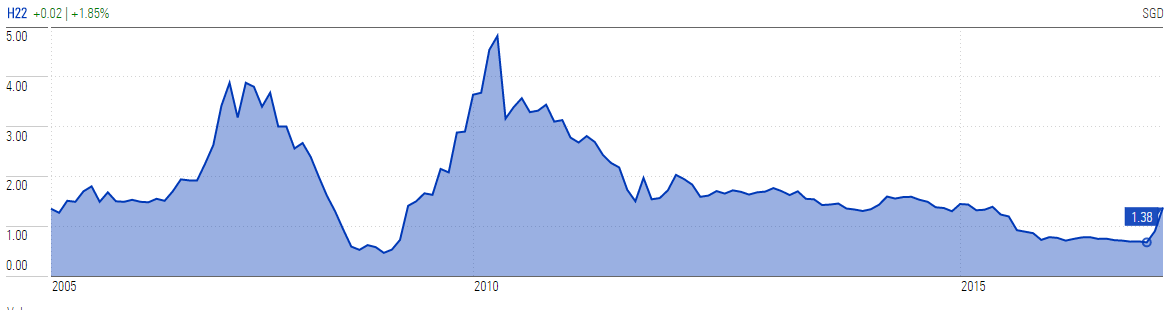

On the 27th of November 2016, I noted an entry into my investing journal. My modus operandi is to create a master folder of companies that I am interested in. And within these folders contain the information with which I do my research. The folder may also contains annual reports, links to news articles in the media and any filings related to the company. Within 1 of these master folders contained a company called Hong Leong Asia Ltd, a holding company of various subsidiaries operating in diverse industries. It has a total of 5 core business segments. They are:

On the 27th of November 2016, I noted an entry into my investing journal. My modus operandi is to create a master folder of companies that I am interested in. And within these folders contain the information with which I do my research. The folder may also contains annual reports, links to news articles in the media and any filings related to the company. Within 1 of these master folders contained a company called Hong Leong Asia Ltd, a holding company of various subsidiaries operating in diverse industries. It has a total of 5 core business segments. They are: